Where to File No of Deductions on Form W4

W4 Form Tax Withholding

So what does W4 mean?

- A waffle 4-pack?

- A brand of washing machines?

- A herd of four warthogs?

- A place to enter your dependents on a tax return?

Actually, it is none of those things! It is most likely that the "W" in W4 or W-4 stands for "withhold" or "withholding" (to take out), but we do not know what the "4" means or why it is there in the first place! Find out why the W-4 is designed so complicated?

What is a W-4 Form?

The W-4 is a form that you complete and give to your employer (not the IRS) for federal tax and the equivalent form for state tax withholding. The W-4 communicates to your employer(s) how much federal and/or state tax you - and your spouse if s/he works - wish to have withheld from each paycheck in a pay period. Depending on what you enter on your W-4(s), it could affect how big of a tax refund might be due for the given tax year - usually filed the year later - or how much tax you will owe when you file your tax return(s) by Tax Day.

Pick one of four free W-4 tools, calculators and from creators.

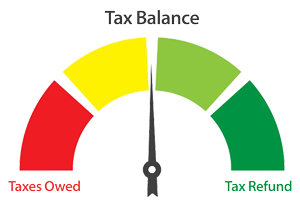

The right amount or balanced amount of tax withholding per pay period for the tax year is good because it keeps you from paying all your taxes at once when you file your income tax return or ITR. Too much tax withholding will result in a tax refund - some argue it's a form of financially self-imposed penalty. Clearly, the trick is to balance your withholding and thus your taxes so you don't owe nor get too big of a tax refund.

Important: We highly recommend you review your W-4 in December or January of each year. Why? Did you know that in 2020, over 101 million tax returns resulted in tax refunds in the amount of over $261 billion dollars? Tax refunds is not "free" IRS or government money, but it is often too much of individual taxpayer's money handed over to the IRS as a result of too much paycheck tax withholding, which is the result of insufficient W-4 form planning: Reap what you sow, thus get started sowing with proper W-4 or tax withholding planning. We view most taxpayer's tax return refunds a self-inflicted financial penalty or wound by the taxpayer.

Free Online W-4 Creator

We at eFile.com understand the Form W-4 can be confusing and overwhelming. We have developed three tools to help taxpayers complete a W-4 online without being a Tax Geek or having extensive tax knowledge. Did you recently take on a new job and are being asked to submit a W-4 to your employer? See below:

- Use your 2021 Tax Year estimates, 2022 estimates, or data from your 2020 Tax Return to prepare your W-4. See how to get a copy of your 2020 Return.

- Take these figures and enter them on one of our three tools: compare eFile.com W-4 adjustment tools here.

- Receive your W-4 Form for your records through your email. Send a copy directly to your employer or simply download your form and send it to them.

- Questions? Contact us here and let us help you get ahold of your tax withholding. Don't give your hard-earned money to the IRS only to get it back as a refund!

When you complete your new 2022 W-4 Form here on eFile.com, you have four options to do so. Pick the best tool here: the W-4 Calculators. Not factoring in your tax return goals when completing a W-4 form is like driving a car mostly through the rear view mirror.

If you are familiar with all these nerdy types of explanations and are ready to get to the bottom line, start here and now:

- Use the new PAYucator so you can see what the actual paycheck withholding is and create your W-4 based on that.

- Then, estimate your 2021 Tax Return to see how your current or estimated tax withholding will impact your next tax return. Estimate your upcoming tax return for 2022 and see what it could be if you adjust your tax withholding.

- See W-4 Instructions for nonresident aliens.

To see how your tax withholding went during the year, prepare your tax return on eFile.com. Start free and report all your tax information - income, deductions - and let us handle the tax calculations for you. Are you owed a refund? Withhold less next year if you do not expect significate changes to your tax situation. Owe taxes? Withhold more to get closer to being tax balanced next year.

W-4 Questions, Answers, Myths, and Facts

Find common tax questions below accompanied by details answering them. Get a better understanding of how to withhold money from your paycheck each month and try to be as tax balanced as possible. Then, prepare your taxes with eFile.com and see how well your withholding practice worked out.

W-4 Question

Answer

Description

Why to File a W4?

A W4 is used to balance taxes on your tax return.

As a wage earner, you determine the amount of money you ask your employer to take out or withhold from each paycheck or pay period as taxes or tax withholding with the W-4 Form. This amount is an important factor on whether you will owe taxes or get a tax refund when you e-File your next tax return.

When to file a W-4 with a new or existing employer?

File this form when starting a new wage earning job or anytime you want to balance your taxes.

1. As soon as you start a new wage earning job, you will have to submit this form to your employer, not IRS.

2. Submit or resubmit anytime you want to balance your taxes due to life changing events. Use the Taxometer and pick a tax balance goal for your next tax return. If you were faced with hardship that affected you financially during 2021, you may want to adjust your withholding in 2022 so you can keep more of your money each paycheck.

How to calculate or estimate the amount of taxes to withhold with each paycheck?

1. Start the free 2021 Tax Calculator or estimate your future 2022 Return now and estimate your tax situation.

2. Discuss your personal tax situation with a Taxpert for free: Contact an eFile Taxpert now.

To get an accurate estimate, you will need to estimate your 2021 or 2022 Tax Return. Simply estimate your income, dependents, tax deductions, and tax credits for 2022 when estimating the 2022 Tax Return. Based on these results, adjust your paycheck withholding - up or down - for the pay periods in 2022. The 2022 W-4 Form no longer has Allowances. Instead, you simply provide amounts to increase or decrease by.

It's about how much of your hard earned money you will get to keep in 2022 and not get back again in 2023 as a tax refund. If you receive a tax refund in 2022 for your 2021 Tax Return, you likely had withheld too much. A refund in 2022 would mean you would give your money to the IRS during 2021 through too much paycheck tax withholding just to get it back in 2022. Wouldn't you want to keep this now and be balanced in 2022? No refund, no taxes owed in 2023.

How to complete a W4 between now and the end of 2022.

Contact us now - we have a free, pragmatic workaround for you. No complicated worksheets and no guessing.

Example: Your 2021 Tax Return showed a $1,200 refund and your 2021 income and deduction situation is not changing for 2021. Take a look at your last pay check, take the tax withholding amount and decrease your withholding by $200 (monthly pay period) or $100 (bi-weekly pay period) between the remaining months of May through December 31, 2021. As a result, you should get a smaller refund in 2022 and not owe taxes, but increase your paycheck per pay period. Do the reverse if you owed taxes on your 2021 Tax Return.

Don't Penalize yourself with a Tax Refund!

Don't do what too many hard working taxpayers do. This self imposed penalty could cost you up to 18% of your income a year. Yes, it's self imposed by wrong financial tax payer planning - not eFile.com nor the IRS. Learn more about self imposed penalties.

How to Fill out your W-4?

Use our Free W-4 Creator Tools! Or, click here for the old fashioned PDF form if you don't want to use any of the tools: Form-W-4.The W-4 is your planning tool to manage your tax withholding and you submit the form to your employer and not the IRS.

1. Complete, sign, and download the W-4 now online here on eFile.com based on these W-4 four tools.

2. Mail, email, or hand it over to your employer(s), not the IRS or state agency. Coordinate this effort with your spouse if you are filing as married filing jointly on your next tax return.

3. Identify the State(s) to change your state tax withholding form(s) and download the appropriate tax withholding form(s) by state. Follow the same tax balancing strategy as you do for the IRS.

Understand Your Tax Refund

The tax refund you may receive at the end of a tax year is not free money. When you receive a check or your direct deposited refund, you are receiving money that was rightfully yours to begin with. Optimize your withholding using our free calculators and keep more of your paycheck each pay period. Use that extra money to pay off any debts instead of relying on a big check in April.

Try these simple calculators to estimate your taxes with up-to-date information. These figures will be reported when you file your tax return on eFile.com. The eFile Tax App will report your situation on your return based on your answers to straightforward tax questions.

Find additional resources on eFile.com below. Get a better understanding of your personal tax situation before you get your taxes done with eFile.com.

- Start the free 2022 Tax Withholding Calculator and estimate your 2022 Tax Return.

- Use the PAYucator to know your paycheck tax withholding before you complete the W-4 Form.

- Follow these tax planning steps and keep your heard earned money now.

- See these tax withholding methods used by employers.

- Find state tax information with individual pages for each state or U.S. Territory.

- Keep up to date with stimulus check payments and taxes. The first stimulus calculator, the second stimulus payment and third stimulus payment calculator.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

Where to File No of Deductions on Form W4

Source: https://www.efile.com/what-is-a-w-4-tax-withholding-form/